espp tax calculator uk

The FMV of the shares are 30 I pay. When you buy stock under an employee stock purchase plan ESPP the income isnt taxable at the time you buy it.

Espp Gain And Tax Calculator Equity Ftw

Weve created this free calculator to help point you in the right direction.

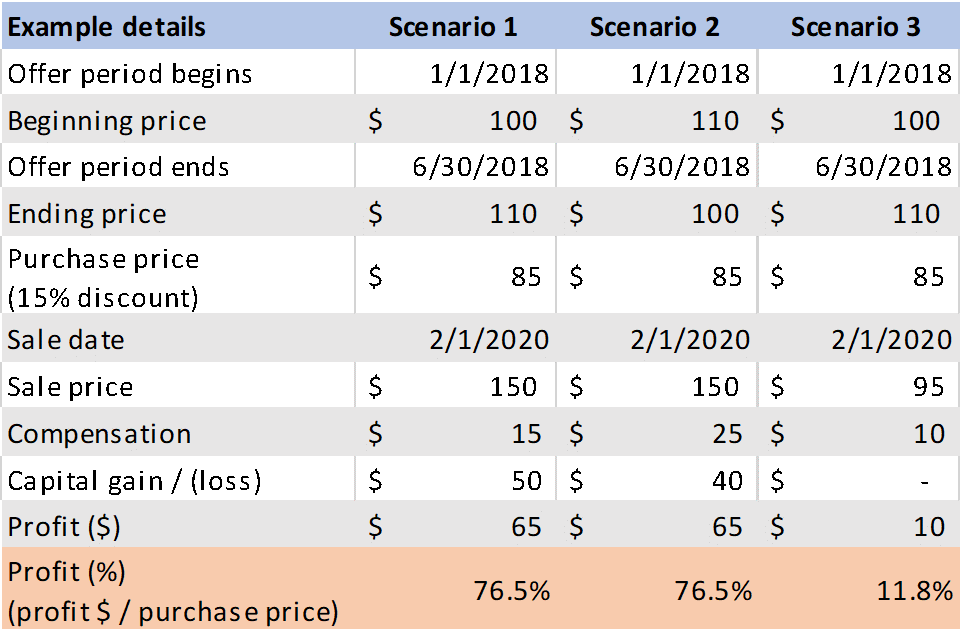

. The ESPP tax rules require you to pay ordinary income tax on the lesser of. The gain calculated using the actual purchase price and. You have an automatic 4 profit which is automatically taxed as a benefit at your marginal tax.

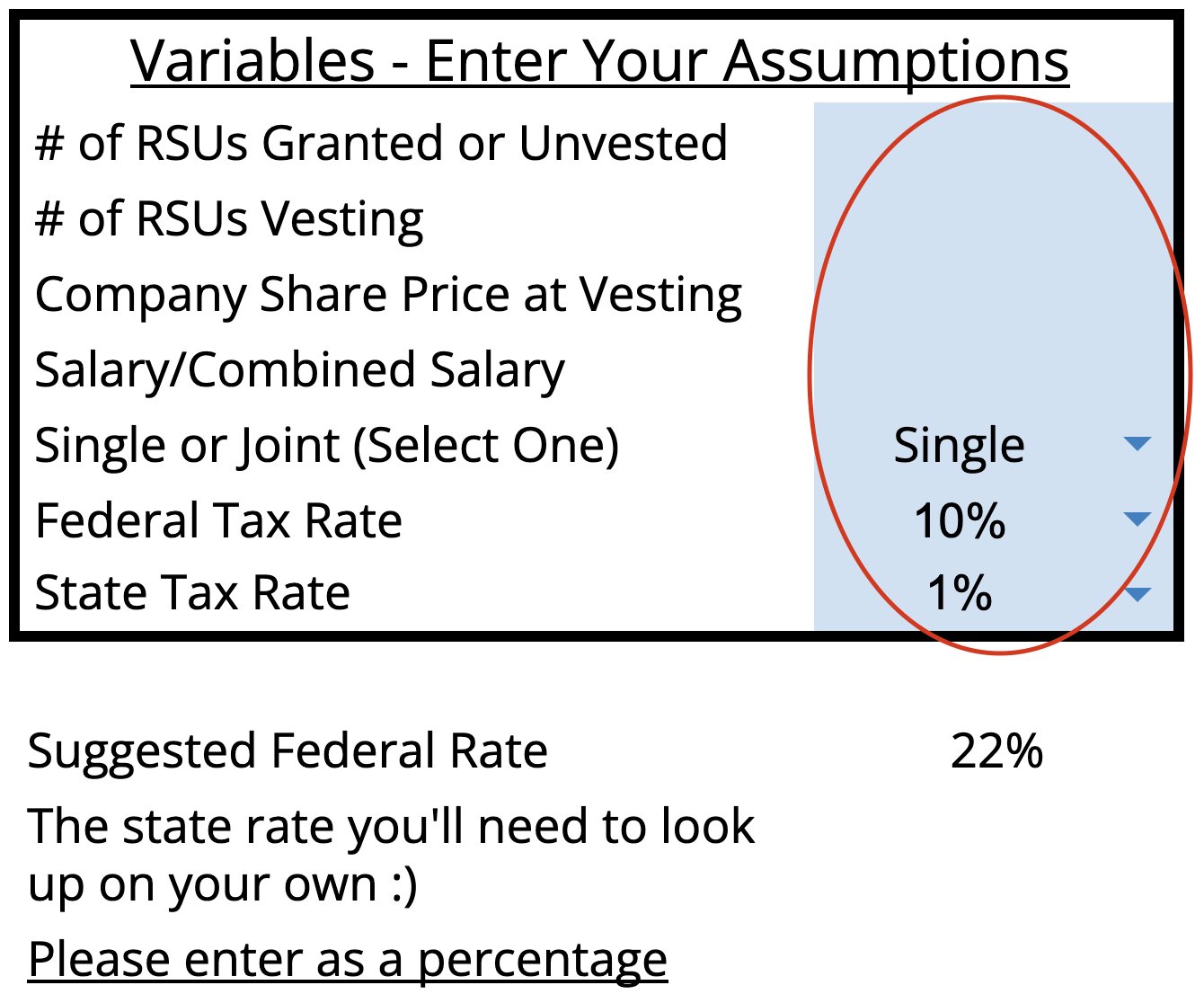

This calculator will help with that. Your work makes Intuit successful and the Employee Stock Purchase Plan ESPP is another way to be rewarded. Employee Stock Purchase Plan ESPP Calculator It is an online tool for tax calculation and used to determine your net gain after tax value on your ESPP based on grant date exercise date.

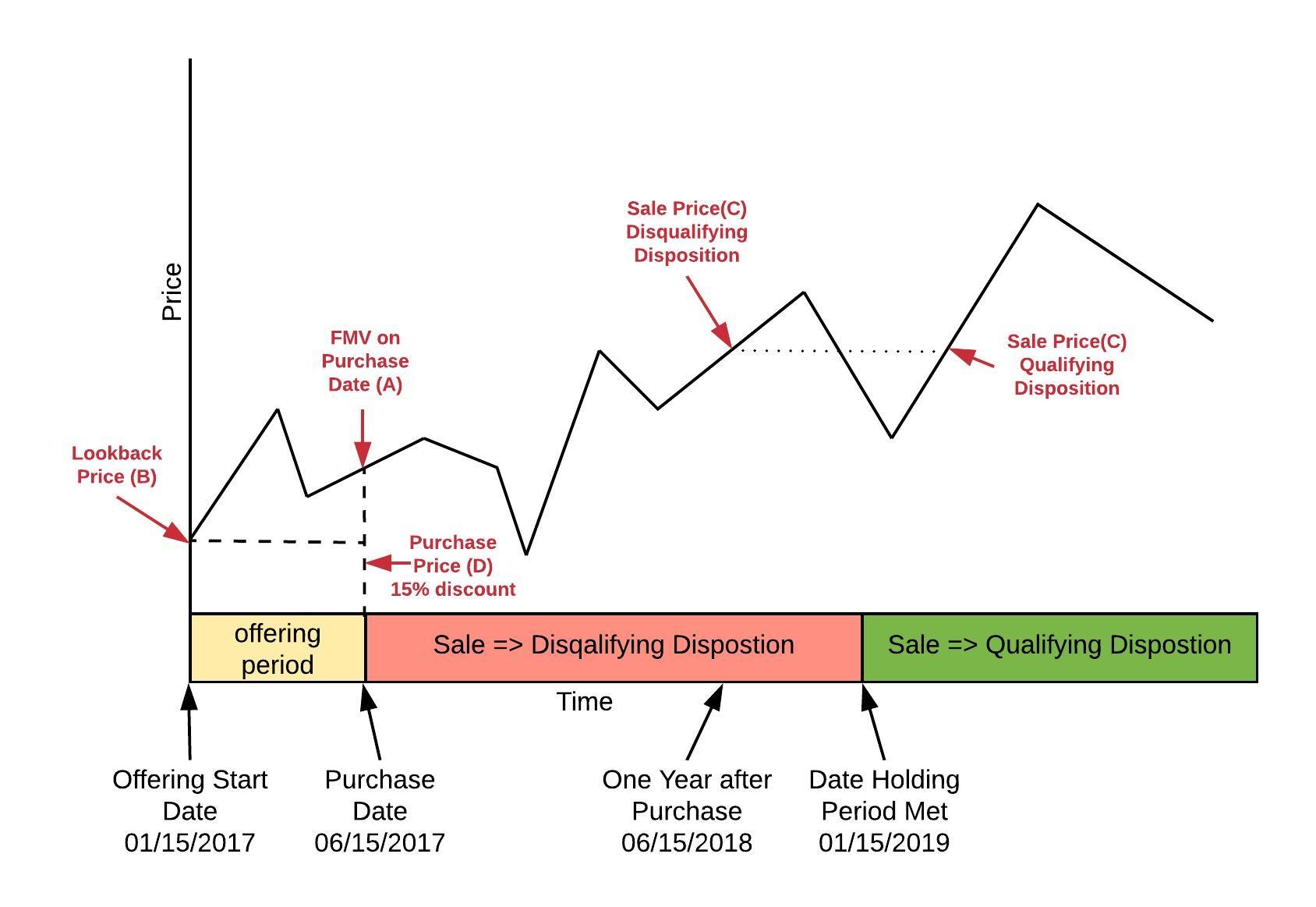

This calculator assumes that your purchase price is calculated picking the lower stock price. This accumulates over a certain period and at the end of that the money is used to purchase shares. Navigating the performance and tax implications of your employee stock purchase plan can be overwhelming.

Most people have trouble calculating adjusted cost basis for filing taxes. The discount offered based on the offering date price or. Market Price on the.

So therefore lets say I put 500 a month in to the share save scheme after tax and NI is deducted at the 12 month plan end I have 6000. Youll recognize the income and pay tax on it when you sell the stock. If you do a same-day sale youll pay ordinary income tax on the gains between your discount price and the current stock price at whatever.

Tax rules for ESPPs are weird. Fees for example stockbrokers fees. First Day of Subscription Period Market Price on the First Date of Subscription Period.

Under a nonqualified ESPP when the shares are. Tax advantages on employee share schemes including Share Incentive Plans Save As You Earn Company Share Option Plans and Enterprise Management Incentives. If your employer has a 20 discount for you you pay 16 for the ABC stock.

This calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and the first date of the subscription period. Employee Stock Purchase Plan. How to Use the ESPP Gain Tax Calculator Step 1 - Download a Copy To get the most out of this ESPP Gain and Tax Calculator youll want to download a copy of it.

If the purchase price is less than 100 of the fair market value of the shares on the purchase date then the discount is taxed as ordinary income. I will be contributing 150. You can deduct certain costs of buying or selling your shares from your gain.

You choose a percentage that will be withheld from your payslip each month say 5. Stamp Duty Reserve Tax SDRT when you. The ESPP tax rules require you to pay ordinary income tax on the lesser of.

The ESPP gives you the chance to own a. Ordinary Income Tax Owed 57600 Same as the above example Short Term Gains Tax Owed 24 x 750000 180000 Total Tax 237600 Just because you pay. The share price of our company is recorded on March 1st and August the 31st we get to buy the shares at the minimum of the two with an additional 15 discount.

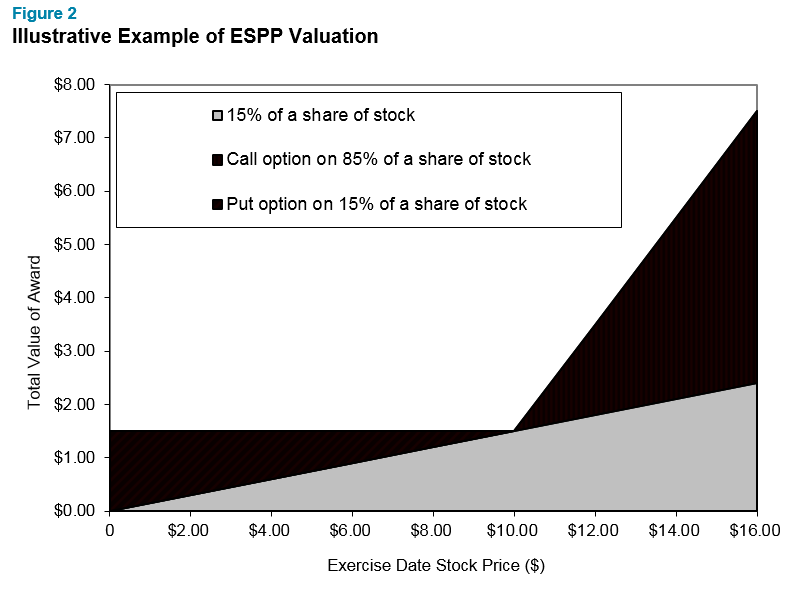

An ESPP employee stock purchase plan is an employee ownership plan that allows participants to purchase stock in their companies at a discount often between 5-15.

Employee Stock Purchase Plans Espps Understanding And Maximizing A Great Employer Benefit You May Be Missing Out On Sensible Financial Planning

Determining The Fair Value Of Your Espp Human Capital Solutions Insights

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Espp Gain And Tax Calculator Equity Ftw

Employee Stock Purchase Plan Or Espp

Is An Employee Stock Purchase Plan Espp Better Than A Retirement Account Early Retirement Now

Employee Stock Purchase Plan Espp The 5 Things You Need To Know

Tax Time Making Sense Of Form W 2 When You Have Stock Compensation

/Investopedia_EmployeeStockPurchasePanESPP_Final-41c7a310275f4bb5912cf912acdd98ca.jpg)

Employee Stock Purchase Plan Espp What It Is How It Works

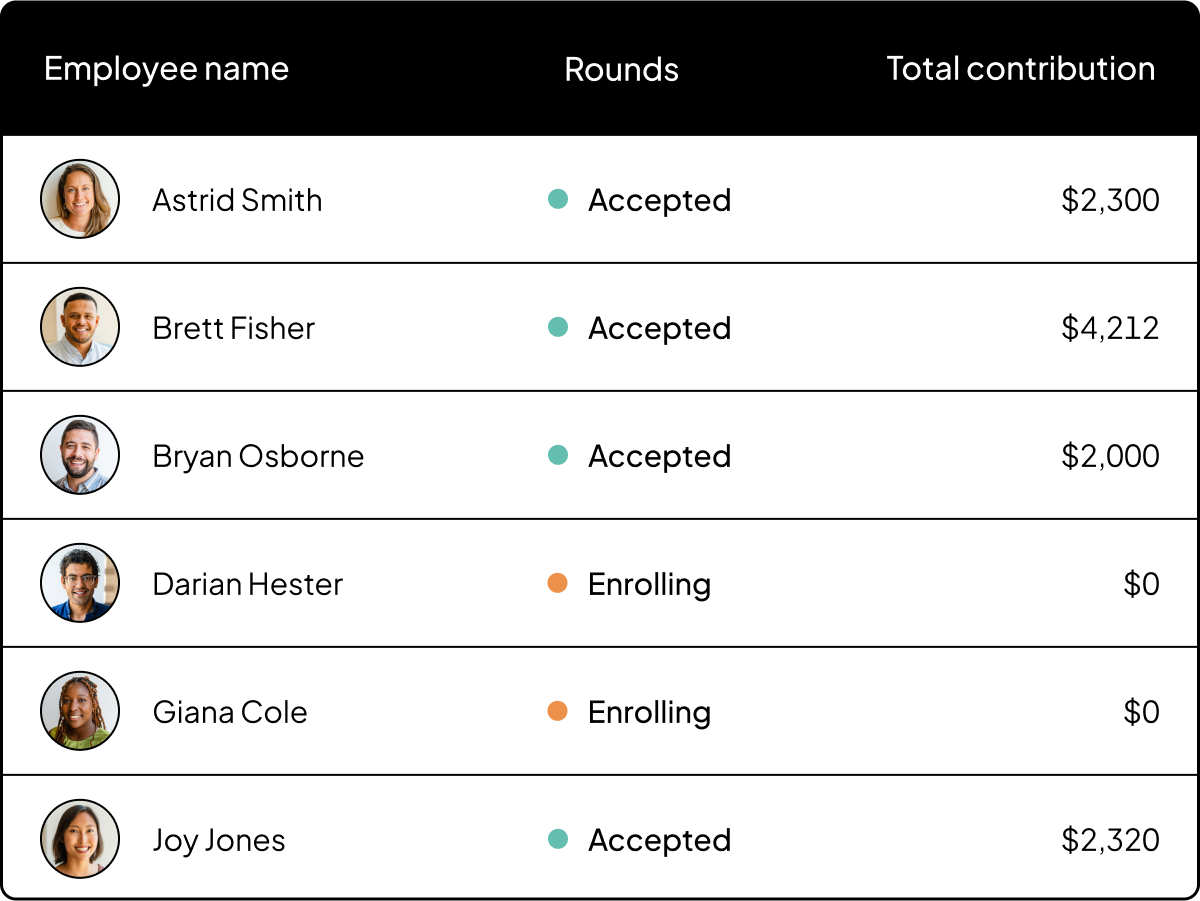

Employee Stock Purchase Plan Espp Software Carta

![]()

Uktaxcalculators World Tax Calculator And Take Home Comparison Uk Tax Calculators

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Is An Employee Stock Purchase Plan Espp Better Than A Retirement Account Early Retirement Now

What Is An Offering Period Or Enrollment Period Mystockoptions Com

2018 Employee Stock Purchase Plans Survey Deloitte Us

The Ins And Outs Of Espp S Part 2 Fun With Taxes Financial Geekery

6 Big Tax Return Errors To Avoid With Employee Stock Purchase Plans