free cash flow yield explained

Free Cash Flow Yield Finding Gushing Cash Flow for Future Growth Cash is king and free cash flow is the oil that runs the engine. Free Cash Flow Yield is a metric that measures how much free cash flow the company generated for investors relative to the price that investors have to pay to buy their stake.

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield.

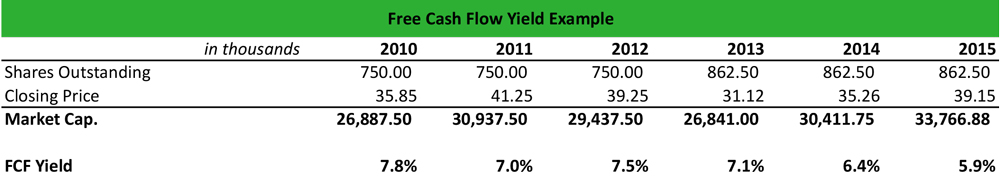

. Investors who wish to employ the best fundamental indicator should add free cash flow yield to their repertoire of financial measures. The Wood Pellet Stock Thats a Great Dividend-Yield Play. To find the free cash flow yield percentage divide free cash flow by market capitalization.

ROE ROA ROI Return On Tangible Equity Amazon annualquarterly free cash flow history and growth rate from 2010 to 2021. If the company has 200 in free cash flow last year the cash yield is 200 divided by 10000 or 20 per 1000 share. Httpsamznto3LGhEoHMy favorite Investment Book.

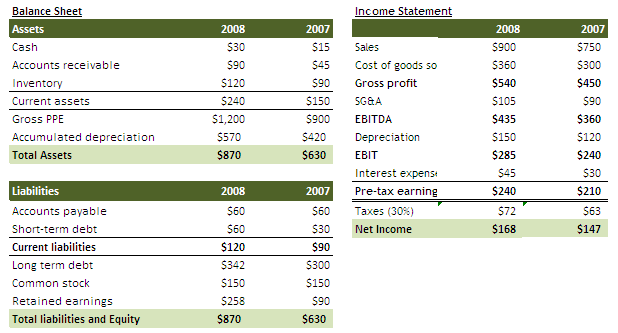

It is computed as the product of the total number of outstanding shares and the price of each share. Step 2 Non-Cash Expenses. Cash flow operations is calculated by making cash flow statement and net profit is calculated by making profit and loss account.

During the past 12 months the average Free Cash Flow per Share Growth Rate of CVS Health was 1590 per year. Key Takeaways A higher free cash flow yield is ideal because it means a company has enough cash flow to satisfy all of its obligations. FCF Yield is the answer.

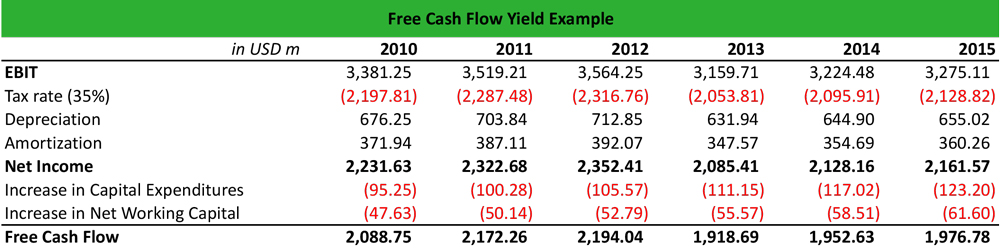

Cash Flow Yield Ratio Cash flow from operations Net Profits CFYR CFFO NP 2nd Cash Flow Ratio. Using free cash flow yield to measure the sustainability of a company may produce potentially higher returns and more attractive upsidedownside. Free Cash Flow Yield Free Cash Flow Market Capitalization.

A study of professional analysts substantiates the importance of free cash flow valuation Pinto Robinson Stowe 2019. What if the price of the stock goes down to 800. When valuing individual equities 928 of analysts use market multiples and 788 use a discounted cash flow approach.

Free cash flows provide an economically sound basis for valuation. The ratio of Free Cash Flow to a companys enterprise value FCF Enterprise Value. What free cash flow means for a company and why investors should definitely look at it before buying in.

The Free Cash Flow Yield Cash Flow Yield The free cash flow yield is a financial ratio that compares the free cash flow per share to the market price per share to determine how much cash flow the company has in the event of liquidation. Free cash flow yield is really just the companys free cash flow divided by its market value. Free cash flow yield offers investors or stockholders a better measure of a companys fundamental performance than the widely used PE ratio.

To break it down free cash flow yield is determined first by using a companys cash flow statement Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period subtracting capital. We can also compare the FCF Yields to bond yields. Free cash flow can be defined as a measure of financial performance calculated as operating cash flow minus capital expenditures.

Net Income Net Income is a key line item not only in the income statement. Heres the fun part. If the free cash flow yield is low it means investors arent receiving a very good return on the money theyre.

Cash Flow Yield Ratio This ratio shows the relationship between cash flow from operations and Net Profit of Company. Read more divided by its total free cash flow. Thats 2 the same as the bond.

In depth view into Zumiez Free Cash Flow explanation calculation historical data and more. HSBC Offers A Range Of Solutions To Help You Gain More Control Over Your Cash Flow. Free Cash Flow Yield Cash Flow from Operations Capital Expenditures Enterprise Value.

How to Derive the Free Cash Flow Formula Step 1 Cash From Operations and Net Income. Reduce Debt And Enhance Your Balance Sheet. During the past 3 years the average Free Cash Flow per Share Growth Rate was 2190 per year.

You should not depend on just one measure of course. We can use the FCF Yield to rank all stocks on an apples-to-apples basis. Free Cash Flow Yield measures the amount of cash flow that an investor will be entitled to.

One of the Most Important Metrics in Finance Free cash flow is the most important metric in finance. The free cash flow yield gives investors an idea. The standard way to calculate free cash flow yield is to use market capitalization or total common shares outstanding times the share price.

We can further break down non-cash expenses into simply the sum of all items listed on the. Free Cash Flow Explained. Free Cash Flow Yield FCFY We can take this relevant information and produce a ratio that is one of the most useful metrics in stock analysis.

It is mechanically similar to thinking about the dividend or earnings yield of a stock. Beyond profit free. Httpsamznto35cbAn0Fundsmith founder Terry Smith explains free cash-flow yield.

The cash yield of the stock jumps to 25. You need to sign up for a Lumovest subscription in order to join discussions. Free Cash Flow FCF is a financial performance calculation that measures how much operating cash flows exceed capital expenditures.

Ad Manage Cash Flows More Efficiently. Free Cash Flow Uses. This ratio expresses the percentage of money left over for shareholders compared to the price of the stock.

Free Cash Flow Yield. Determining free cash flow and the different uses is a fantastic. ZUMZ Free Cash Flow as of today March 05 2022 is 118 Mil.

Amazon free cash flow for the quarter ending December 31 2021 was -906900 a year-over-year. Its free cash flow per share for the trailing twelve months TTM ended in Dec. In other words it measures how much available money a company has left over to pay back debt pay investors or grow the business after all the operations of the company have been paid for.

What Is Free Cash Flow Yield Definition Meaning Example

Unlevered Free Cash Flow Definition Examples Formula

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Unlevered Vs Levered Fcf Yield Formula And Excel Calculator

Free Cash Flow Uses One Of The Most Important Metrics In Finance

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow Efinancemanagement

Free Cash Flow To Firm Fcff Unlevered Fcf Formula

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Formula Top Example Fcfy Calculation

What Is Free Cash Flow Yield Definition Meaning Example

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Unlevered Vs Levered Fcf Yield Formula And Excel Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)